OPTION WHEEL IN ACTION – 19% Return

Sell long shares that have basis at $8.50 from selling cash put and writing covered calls in March and May..

STRATEGY: Sell cash secured put, get shares, create covered call, REPEAT…OPTION WHEEL

NEW ALERT : SELL GPRO shares to close out position.

View Original December 9th Trade Below.

New Trade Alert for (GPRO)

GOPRO CASH SECURED PUT SALE

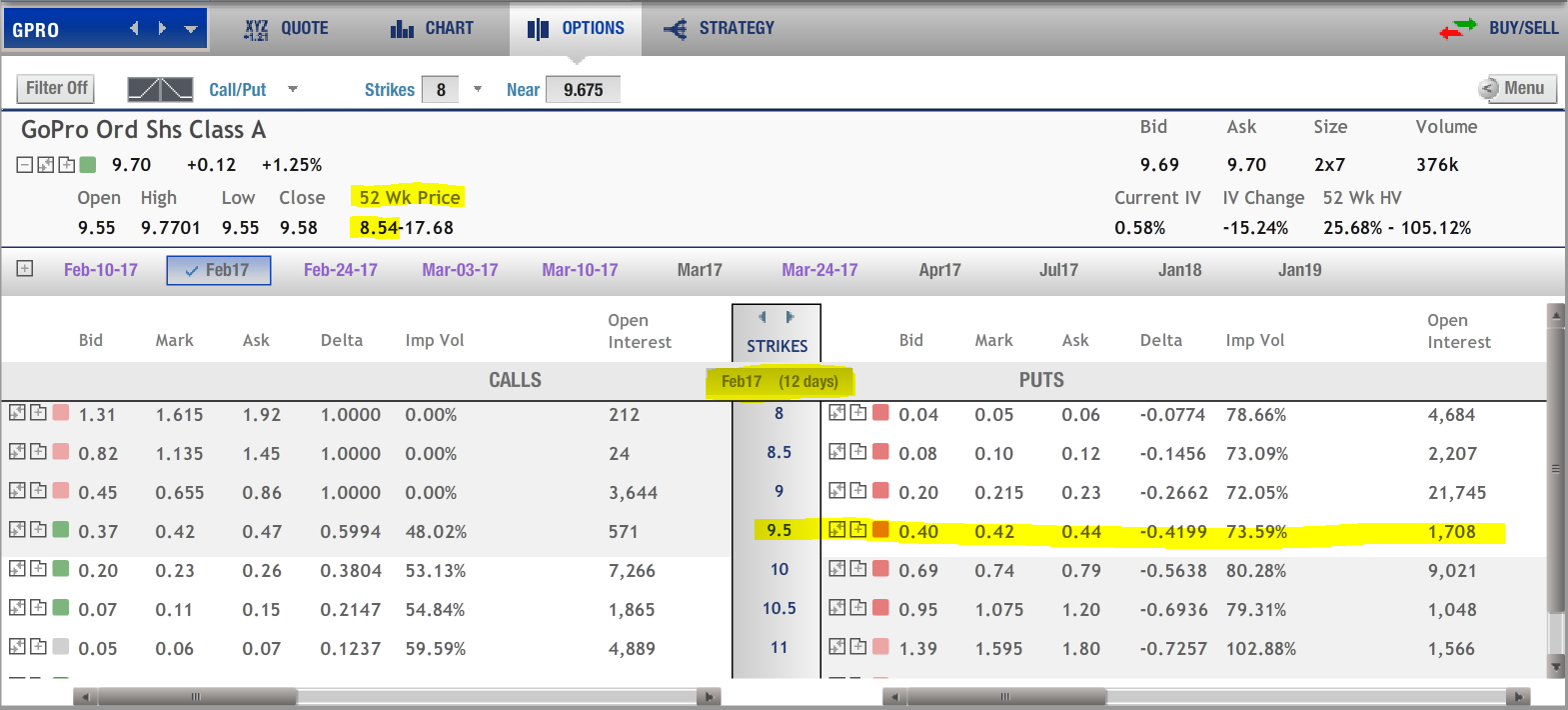

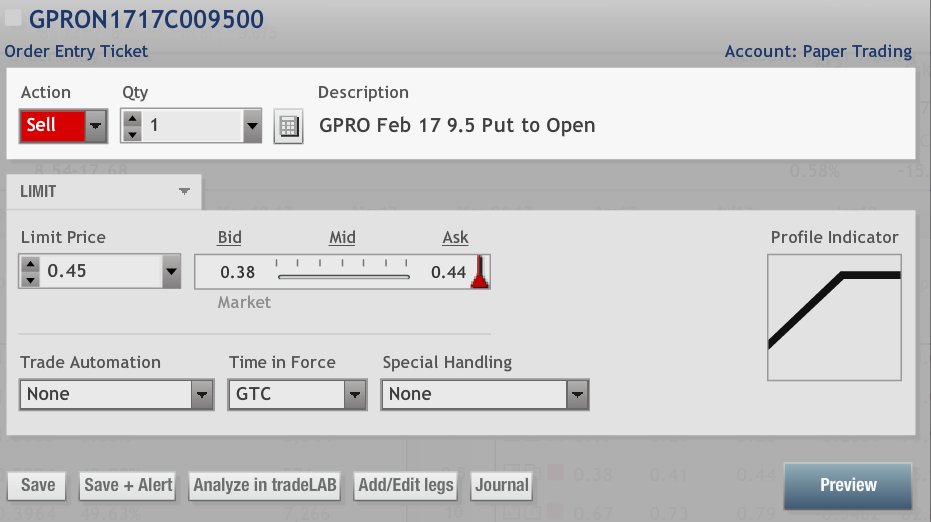

Sell February GPRO $9.50 Put @$0.45 or more to open

Risk Rating: 3.5 (1 = lowest 5 = highest)

Above Break Even Probability: 74%

5% return on risk in two weeks or get long shares at $9.05.

HIGH PROBABILITY 5% potential return in less than two weeks

BUY GoPro another 6% Lower, or Get Paid Not To…

Volatility is OPPORTUNITY… to sell Cash Secured Puts

The crucial measure of payoff for an investment is RETURN on RISK.

Controlling and quantifying risk is the primary job of an investor. Once the worst case scenario is determined downside exposure to ANY possible event is calculated in dollar terms and financial impact on the portfolio only then can participation be weighed

Risk and Probability are the factors that can be controlled using options as the most positive attributes. The super leverage benefit is secondary to the ability to know the maximum cost of any potential catastrophic stock move.

Trends in technology are tricky…ask Apple, which until recently had been vilified by the market for not producing something new though it was producing exorbitant revenues and had more cash on hand than most than most S&P company market caps.

In the “what have you done for me lately” conundrum category GoPro share price has fallen 70% since the $24 IPO. GPRO has gone down from the $87 top in 2014 to under double digits.

A base may be in place with the stock sideways mostly between $8.50 and $9.50 for the last six weeks.

The $9 midpoint of the sideways is a support level to lean on.

The option volatility at the 60% level makes the option expensive in relative value compared to the market itself. Option selling strategies take advantage of the increased premiums.

The potential return on risk is 5% is attractive with a $9.05 breakeven at the option expiration.

The FOREVER low in GoPro is $8.54.

Buying at support and a 6% discount price if assigned is a way to position for a long term recovery in a single digit stock…. Or to get paid not to buy it at these extreme low levels.

The high implied volatility makes option selling strategies attractive as pure probability trades that utilize time decay acceleration. The May options have three weeks until expiration.

One tactic to buy at a lower price, or get paid not to, is used by money managers to buy stocks they WANT for long term portfolio positioning. Use others fears for your benefit by selling a CASH SECURED PUT to enter the stock at a major discount.

Option tactics can be employed to make money in Up, Down and Sideways action to take advantage of other variables or time and volatility.

The fear and uncertainty can be used to get in another 6% lower for those who are at worst are comfortable holding on to an inexpensive stock to wait for a potential recovery.

Portfolio Strategy

The straightforward Price Order to buy a stock at a lower level is common if it can be determined where it is comfortable to get in below current prices. Put in the trade at “X” and wait for the dip to enter.

Professional money managers have certain points at which they would buy a desirable stock but an option strategy lets them get in at discount or get paid not to.

Selling a CASH SECURED put, has the same mathematical risk profile as a covered call, would assign the stock long at the option strike price. The true entry basis is actually even lower with the subtraction of the premium.

With the Put sale there is an OBLIGATION to buy at the strike price if it is assigned.

However, if the stock is not below the strike at expiration the premium received is all profit. Get in the stock at a discount or get paid not to…

There are two rules that Cash Secured Puts traders need to follow to be successful.

Rule One: ONLY SELL PUTS ON STOCK YOU WANT TO OWN.

Have the funds in the account to buy the stock at a discount if a selloff continues.

The intention is to be assigned the stock, each option represents 100 shares, as a long-term investment. Paying in full ensures that no additional money is needed to hold for potentially many, many months or even years until price recovery.

Rule Two: Sell either of the front two option expiration months to take advantage of time decay.

Collect premium every month on put sales until assigned shares at a cost reduced basis. Every month that you keep the premium is money subtracted from the entry price.

Trade Setup: Sell the GPRO February $9.50 Puts to open at $0.45 or better. The cash secured Put sale would assign long shares at $9.05 if it is put to you costing $905 per option sold.

ONLY sell this put if you want to own the shares at a discount to the current price.

The combination of time decay and 70%+ probability of GPRO finishing above the $9.05 break even make the option sale attractive. In fact, that $9.05 level is 50 cents above the all time stock low.

If assigned shares, a March covered call can be sold against the stock to lower the cost basis again when you own it.

If GPRO stock does move lower, buy the shares for 6% cheaper than the current share price.

Otherwise, you get paid not to… and get a 5% return on risk in a month with 70% probability.

This strategy profits if GPRO rises, trades sideways or even falls as long it remains above the $9.05 break even 6% below on the February 17th expiration date.

Leave a Reply