New Trade Alert for (IWM)

Russell 2000 Exchange Traded Fund

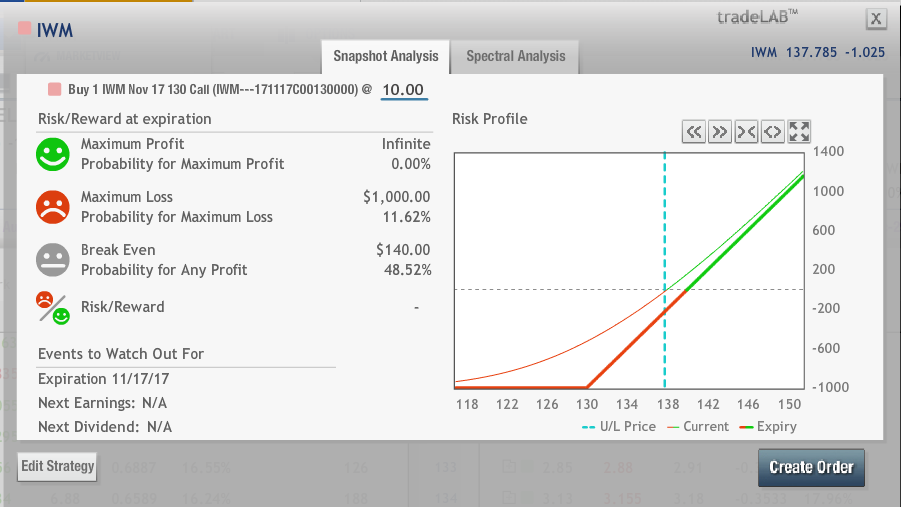

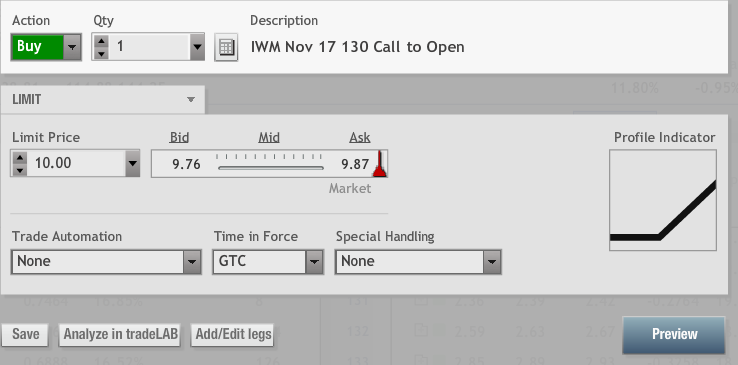

Buy IWM November $130.00 Call @$10.00 or less

Risk Rating: 3.00 (1 = lowest 5 = highest)

Above Break Even Probability: 48 %

Probability of maximum loss: 12%

Place Stop Loss at half of premium paid.

Rotation Equation II

Small Caps with BIG PROFIT POTENTIAL

Bulls Eye Option exit July 19th 33% IWM winner in two months

WOW!!! the story of the markets is as much about what is happening and a rally back to one good day’s performance away from ALL TIME HIGHS…as what didn’t happen when set up for a fall.

The July and August rally run saw profit taking sales to capture gains and bank some of the Bull Market performance.

In another example of “IT’S NOT DIFFERENT THIS TIME” the volatility VIXplosion to the highest levels since November was quickly erased like we have seen time and time again.

The market reaction to potential Nuclear action was less than all of the crisis de jour that have shaken stocks in the past.

The list is long but just in 2016 the Brexit surprise and China Black Monday a much larger impact than a serious military confrontation…

Stocks are strong with S&P up 10% in 2017 and closing in on the 2500 longstanding measured move objective. That positive performance is HALF of the Tech triumph that has led the rocket rally.

Money should flow to better value to offer more attractive reward to risk ratios.

The IWM Russell 2000 Exchange Traded Fund has under performed so far up 2% YTD.

Opportunity exists to profit from fund rotation into the lagging small cap sector.

Russell 2000 IWM stalled and is stuck trading between $130 and $140 in 2017.

A pullback has brought the small caps to the $135 midpoint support to lean on.

Instead of buying long shares, a stock substitution strategy limits risk to the premium paid with unlimited upside profit potential. Less capital is required and the risk is less in dollar terms than buying shares outright.

Only close below the $130 level on the weekly basis would negate the multi year trend momentum in the Russell 2000 index.

The Options Way: Unlimited Upside Potential with Limited Risk.

An IWM long call option can provide the staying power in a potential larger trend extension. More importantly, the maximum risk is the premium paid.

One major advantage of using long options instead of buying or selling shares is putting up much less money to control 100 shares — that’s the power of leverage.

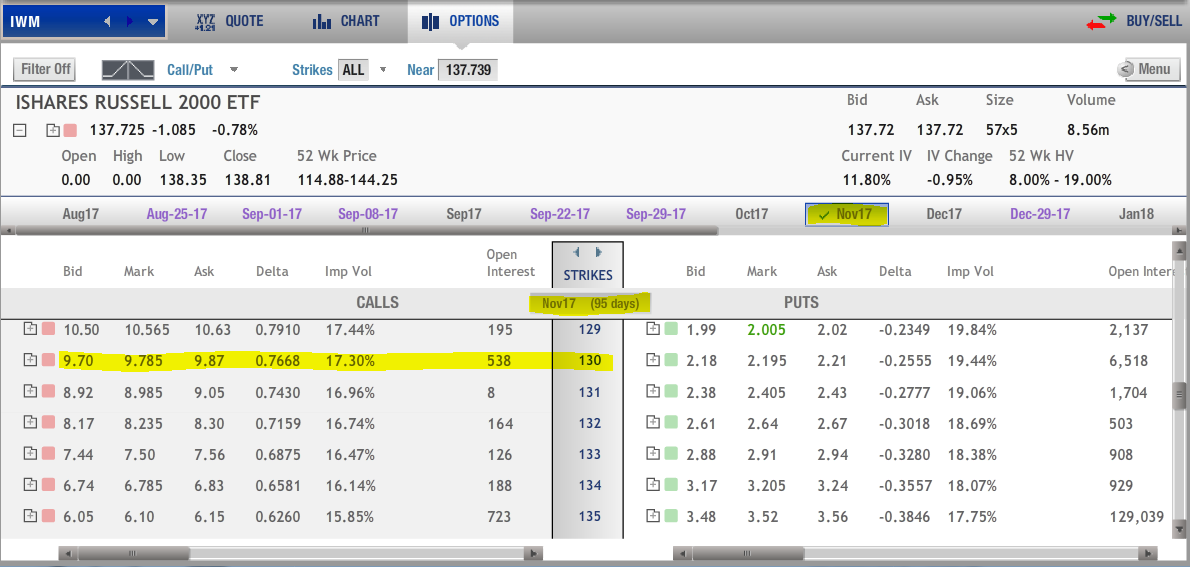

Choosing an option can sometimes be a daunting task with all of the choices and expiration months. Simply put, traders want to buy a high probability option that has enough time to be right.

The option strike price is the level at which you have the right to buy without any obligation to do so. In reality, you rarely convert the option into shares. Simply sell the option you bought to exit the trade for gain or loss.

There are two rules options traders need to follow to be successful.

Rule One: Choose an option with 70%-plus probability. The Delta is a measurement of how well the option reacts to movement in the underlying security.

It is important to buy options that payoff from only a modest price move.

There is no need to ONLY make money on the all but infrequent large price explosion.

Any trade has a fifty/fifty chance of success. Buying options ITM options increase that probability. That Delta also approximates the odds that the option will be In The Money at expiration.

Buying better options is more expensive, but they are worth it — the chances of success are mathematically superior to buying cheap, long shot Out Of The Money lottery tickets that rarely ever pay off.

With IWM trading at $138.00, for example, an In The Money $130.00 strike option currently has $8.00 in real or intrinsic value. The remainder of any premium is the time value of the option.

Rule Two: Buy more time until expiration than you may need. Time is an investor’s greatest asset when you have completely limited the exposure risks.

Traders often buy too little time for the trade to develop. Nothing is more frustrating than being right but only after the option has expired premature to the market move.

Trade Setup: I recommend the November $130 Call at $10.00 or less.

A close below $130 on a weekly basis or the loss of half of the option premium would trigger an exit.

This option strike gives you the right to buy the shares at $130 per share with absolutely limited risk. IWM has not been that low since November.

The November option has three months for BULLISH development. An 76 Delta on this strike means the option will behave much like the IWM ETF.

The maximum loss is limited to the $1000 or less paid per option contract. A stop loss at half of the premium paid puts the exposure at about $500.

The upside, on the other hand, is unlimited.

The IWM option trade break-even is $140.00 at expiration ($130 strike plus $10.0 option premium). That is $2.00 above IWM ’s current price.

A 10% target YTD return in IWM would put the ETF at $148. If that objective is reached the option investment would gain 80%+ to $18.

Leave a Reply