METAL MELT UP

100% Freeport McMoran PROFIT EXIT

Place order to sell the FCX May $12 Call at $5.70 or better for a DOUBLE in a month.

ORIGINAL November 17th TRADE ALERT BELOW filled at $2.70

New Trade Alert for (FCX)

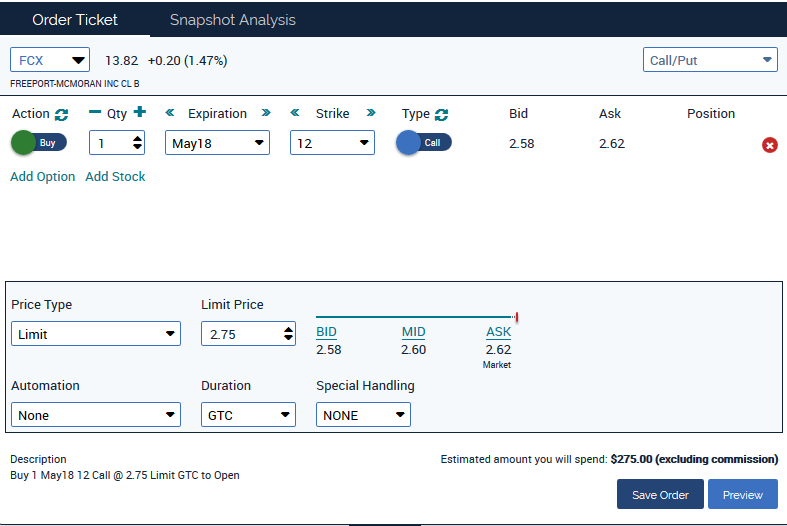

Freeport McMoran Buy May $12 Call @$2.75 or less

Risk Rating: 2.5 (1 = lowest 5 = highest)

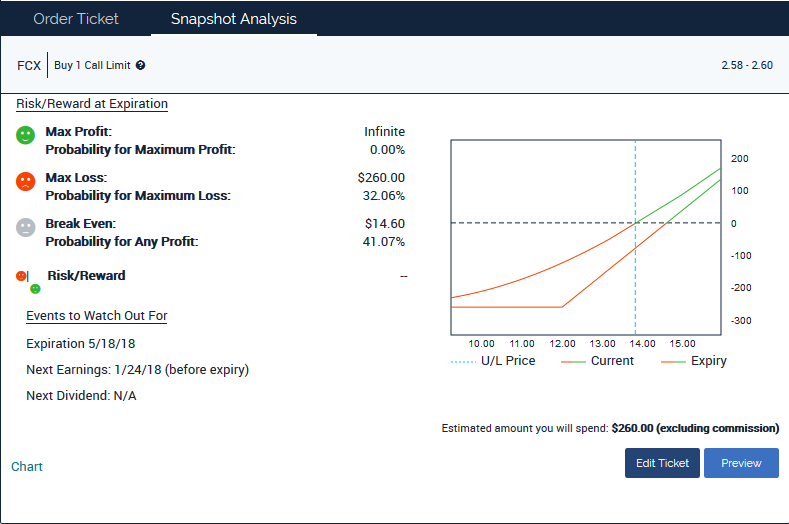

Above Break Even Probability: 41%

Max Loss Probability: 32%

Mining Metal

One of the last remaining holdouts in the rocket rally for markets has metal and miners meandering with some in the sector still negative in 2017.

Commodities have not come back as much keeping a lid the resource sector and those subdued stocks.

The broad market barometer S&P is up an impressive 15% YTD and making another push to the peak. Compare that to Freeport McMoran that has stalled over the last year but offers a good reward to risk at these levels for bullish buyers.

FCX is sideways between mostly $12 and $16 for months with this upside breakout targeting a rally run to $20. The $14 mark is the midpoint pivot right here.

A Freeport McMoran long call options can provide the staying power in a potential larger trend extension. More importantly, the maximum risk is the premium paid for buying the option.

The Options Way: Unlimited Upside Potential with Limited Risk

One major advantage of using long options instead of buying or selling shares is putting up much less money to control 100 shares — that’s the power of leverage.

Choosing an option can sometimes be a daunting task with all of the choices and expiration months. Simply put, traders want to buy a high probability option that has enough time to be right.

The option strike price is the level at which you have the right to buy without any obligation to do so. In reality, you rarely convert the option into shares. Simply sell the option you bought to exit the trade for gain or loss.

There are two rules options traders need to follow to be successful.

Rule One: Choose an option with 70%-plus probability. The Delta is a measurement of how well the option reacts to movement in the underlying security.

It is important to buy options that payoff from only a modest price move. There is no need to ONLY make money on the all but infrequent price explosion.

Any trade has a fifty/fifty chance of success. Buying options ITM options increase that probability. That Delta also approximates the odds that the option will be In The Money at expiration.

Buying better options is more expensive, but they are worth it — the chances of success are mathematically superior to buying cheap, long shot Out Of The Money lottery tickets that rarely ever pay off.

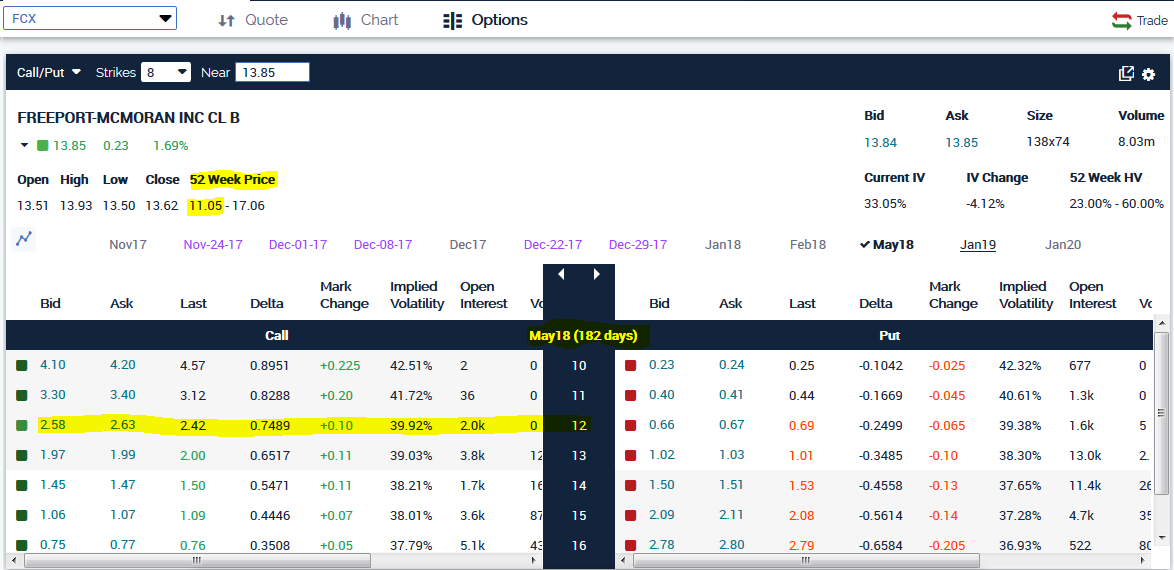

With FCX trading at $13.85, for example, an In The Money $12 strike option currently has $1.85 in real or intrinsic value. The remainder of any premium is the time value of the option.

Rule Two: Buy more time until expiration than you may need — Time is an investor’s greatest asset when you have completely limited the exposure risks.

Traders often buy too little time for the trade to develop. Nothing is more frustrating than being right but only after the option has expired premature to the market move.

Trade Setup: I recommend the May FCX $12 Call at $2.75 or better.

Looking at FCX, the $12 option strike level corresponds with the bottom of the trading channel. This In The Money option gives you the right to buy at a level lower than the present price with absolutely limited risk.

The May option has six months for bullish development.

The maximum loss is limited to the $275 or less paid per option contract. A stop loss exit will be placed at half of the premium paid to limit exposure.

The upside, on the other hand, is unlimited. The In The Money option has a delta of 75% so it will behave much like the stock for a fraction of the cost of owning the shares.

The trade breaks even if FCX is trading at $14.75 or above at expiration ($12 strike plus $2.75 option premium).

The objective is the $20 target from the $12 to $16 sideways range. If FCX moved to that level, the option investment would be worth $8.00 for a gain of 200%.

Leave a Reply