New Trade Alert for (VZ)

Verizon

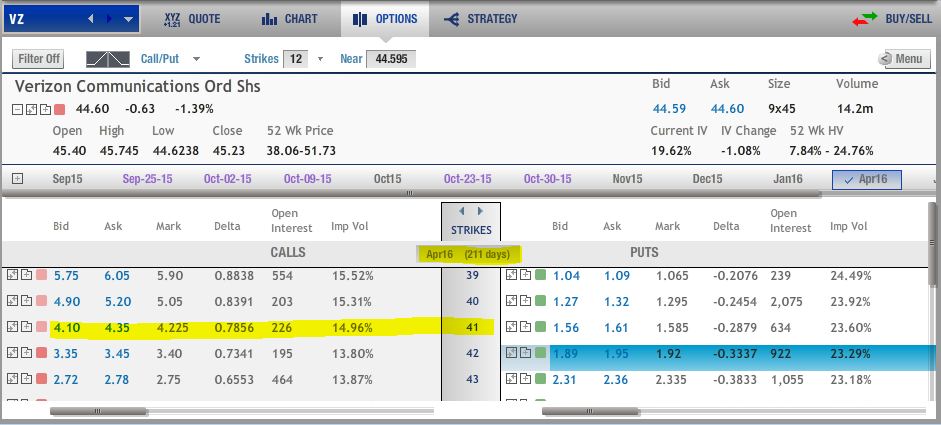

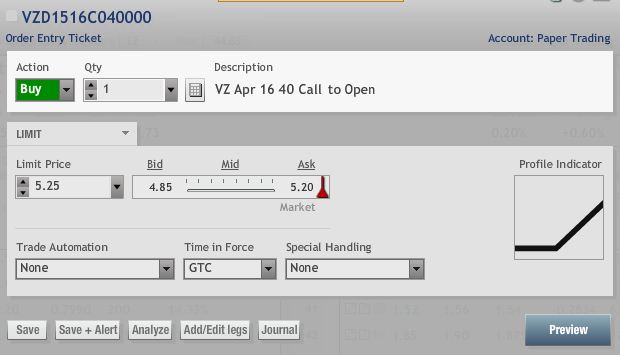

Buy April $40.00 Call @$5.25 or less

Risk Rating: 2 (1 = lowest 5 = highest)

Above Break Even Probability: 51%

Probability of maximum loss: 21%

Place Stop Loss at half of premium paid.

Conservative Call – Verizon On Hold

The dogged Dow is down a relatively reasonable retreat off 5% over the last year while the gains given back may make it seem like a bigger sell off. The Blue Chip index has lagged behind as the broad market S&P is near unchanged over the same time frame and Tech continues its tear up 6% in the NDX over the last 52 weeks.

Verizon has been stuck in a range mostly from $45 to $51 for two plus years. The symmetrical action on both sides of the $48 pivot demonstrates a tight sideways channel pattern in an overall uptrend.

The DOW itself is up 55% over the past five years with Verizon moving from index leader to laggard in the last few years stagnating with performance at 40% over the same period.

A breakout above the $45 old support now resistance targets $48 then $51. A modest dollar move to the channel top is a lucky 13% above the current price.

The reward to risk favors the DOW Bulls at these levels. A third of the Dow components are positive for 2015 with earnings season starting at the beginning of October to put fundamentals in focus once again for stocks.

A stock substitution strategy using options ties up less capital and has absolutely limited risk to the premium paid. An option instead of buying the shares also has greater staying power for long term trend development.

The April option has seven months for Bullish development.

An In-The-Money option gives you the right to be long the shares from a lower strike price and costs much less than the stock itself.

The Options Way: Unlimited Upside Potential with Limited Risk.

A Verizon call option can provide the staying power in a potential bullish trend extension. More importantly, the maximum risk is the premium paid.

One major advantage of using long options instead of buying or selling shares is putting up much less money to control 100 shares — that’s the power of leverage.

Choosing an option can sometimes be a daunting task with all of the choices and expiration months. Simply put, traders want to buy a high probability option that has enough time to be right.

The option strike price is the level at which you have the right to buy without any obligation to do so. In reality, you rarely convert the option into shares. Simply sell the option you bought to exit the trade for gain or loss.

There are two rules options traders need to follow to be successful.

Rule One: Choose an option with 70%-plus probability. The Delta is a measurement of how well the option reacts to movement in the underlying security. It is also important to buy options that payoff from only a modest price move.

There is no need to ONLY make money on the all but infrequent long shot price explosions.

Good Options can profit from only modest directional moves.

Any trade has a fifty/fifty chance of success. Buying options ITM options increase that probability. That Delta also approximates the odds that the option will be In The Money at expiration.

Buying better options are more expensive, but they are worth it — the chances of success are mathematically superior to buying cheap, long shot Out Of The Money lottery tickets that rarely ever pay off.

With VZ at $44.75, for example, an In The Money $40 strike option currently has $4.75 in real or intrinsic value. The remainder of any premium is the time value of the option.

Rule Two: Buy more time until expiration than you may need — at least three to six months for the trade to develop. Time is an investor’s greatest asset when you have completely limited the exposure risks.

Traders often buy too little time for the trade to develop. Nothing is more frustrating than being right but only after the option has expired premature to the market move.

Trade Setup: I recommend the VZ April $40 Call at $5.25 or less. A close in the stock below $42 on a weekly basis or the loss of half of the option premium would trigger an exit.

An option play also has staying power with the ability to ride through Ups and Downs that would force most stock traders out of the position.

The option also behaves much like the underlying stock with a much less money tied up in the investment. The Delta on the $40 strike call is 79%.

The April option has seven months plus for bullish development. This option is like being long the stock from $40 with completely limited risk, and stands just above the $38 three year low.

The maximum loss is limited to the $525 or less paid per option contract, with a stop at $250. The upside, on the other hand, is unlimited.

The VZ option trade break even is $45.25 or less at expiration ($40 strike plus $5.25 or less option premium). That stands less about 50 cents higher than the current trade.

If shares hit the $51 price target the option would be worth near $11 for a 100% return on investment.

Leave a Reply