New Trade Alert for (EWZ)

Brazil Exchange Traded Fund

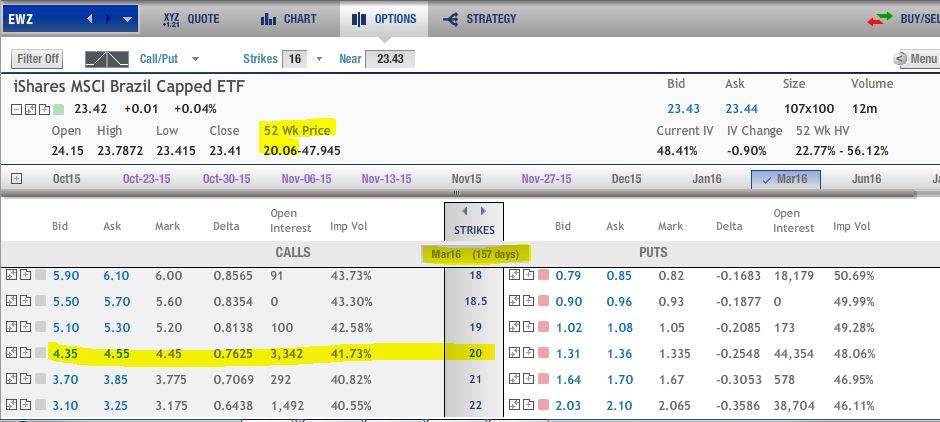

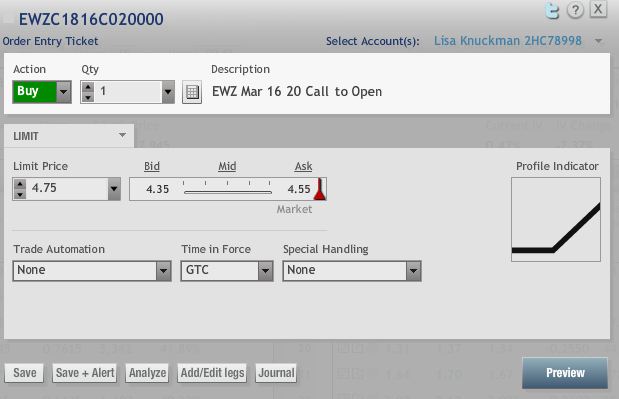

Buy March EWZ $20.00 Call @$4.75 or less

Risk Rating: 3 (1 = lowest 5 = highest)

Above Break Even Probability: 44%

Probability of maximum loss: 29%

Place Stop Loss at half of premium paid.

Crushed Commodity Country – Brazil Bounce 10 Year Bottom

Commodities and resource stocks have suffered with the Dollar surge. The downward price scourge has stalled with a bottom in place after sharply oversold conditions.

A FXC Canadian Dollar call recommendation recently served as a proxy for an Oil bottom.

Instead of using the flattened Brazilian Real, an Exchange Traded Fund covering that commodity county is the choice.

A once shining emerging market economy has tarnished and given back big gains. Big Picture, in comparison to the S&P, Brazil is at the base breakout as a buy.

EWZ has fallen on hard times down to the lowest levels in ten years. A breakdown below the multiyear support saw selling to the $20 extreme low.

Instead of buying long shares, a stock substitution strategy limits risk to the premium paid with unlimited upside profit potential. Less capital is required and the risk is less in dollar terms than buying shares outright.

Only close below the $21.00 on the weekly basis would negate the bullish premise.

The Options Way: Unlimited Upside Potential with Limited Risk.

A EWZ long call option can provide the staying power in a potential recovery rally. More importantly, the maximum risk is the premium paid.

One major advantage of using long options instead of buying or selling shares is putting up much less money to control 100 shares — that’s the power of leverage.

Choosing an option can sometimes be a daunting task with all of the choices and expiration months and strikes. Simply put, traders want to buy a high probability option that has enough time to be right.

The option strike price is the level at which you have the right to buy without any obligation to do so. In reality, you rarely convert the option into shares. Simply sell the option you bought to exit the trade for gain or loss.

There are two rules options traders need to follow to be successful.

Rule One: Choose an option with 70%-plus probability. The Delta is a measurement of how well the option reacts to movement in the underlying security. It is important to buy options that payoff from only a modest price move.

There is no need to ONLY make money on the all but infrequent large price explosion.

Any trade has a fifty/fifty chance of success. Buying options ITM options increase that probability. That Delta also approximates the odds that the option will be In The Money at expiration.

Buying better options is more expensive, but they are worth it — the chances of success are mathematically superior to buying cheap, long shot Out Of The Money lottery tickets that rarely ever pay off.

With EWZ trading at $23.60, for example, an In The Money $20.00 strike option currently has $3.60 in real or intrinsic value. The remainder of any premium is the time value of the option.

Rule Two: Buy more time until expiration than you may need. Time is an investor’s greatest asset when you have completely limited the exposure risks.

Traders often buy too little time for the trade to develop. Nothing is more frustrating than being right but only after the option has expired premature to the market move.

Trade Setup: I recommend the EWZ March $20 Call at $4.75 or less. A close below $21 on a weekly basis or the loss of half of the option premium would trigger an exit.

This option strike gives you the right to buy the shares at $20 per share with absolutely limited risk. The 10 year plus low is $20.06 therefore this option can let you buy in at a major discount.

The March option has over five months for BULLISH development. A 77 Delta on this strike means the option will behave much like the stock.

The maximum loss is limited to the $475 or less paid per option contract. A stop loss at half of the premium paid puts the exposure at $235. The upside, on the other hand, is unlimited.

The EWZ option trade break-even is $24.75 at expiration ($20 strike plus $4.75 option premium).

A push above $26 targets a recovery to $30 old long term support. That recovery objective would double the option investment to $10.00 plus.

Leave a Reply