New Trade Alert for (FXC)

CurrencyShares Canadian Dollar

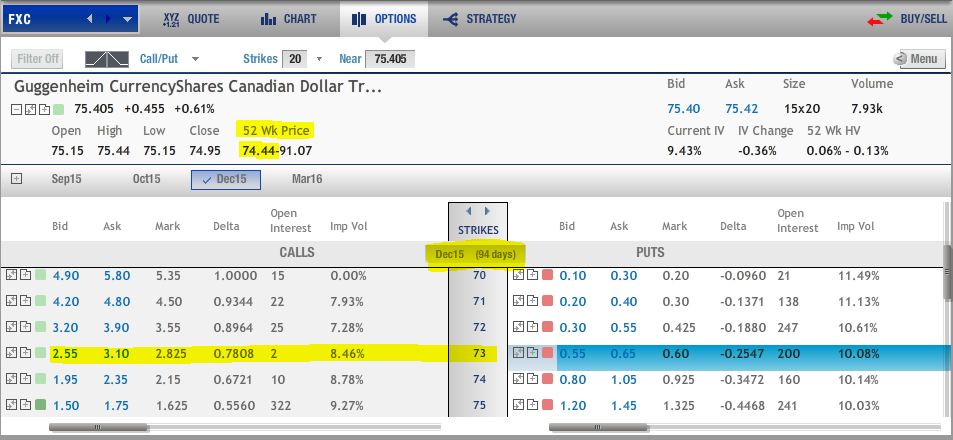

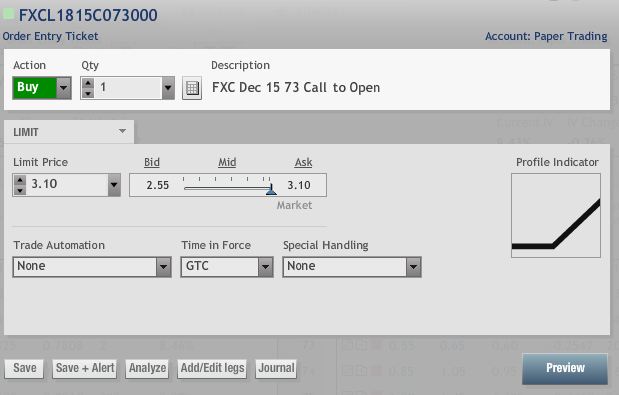

Buy December FXC $73.00 Call @$3.10 or less

Risk Rating: 2 (1 = lowest 5 = highest)

Above Break Even Probability: 52%

Probability of maximum loss: 17%

Place Stop Loss at half of premium paid.

Oh (Ouch) Canada Currency

Asset deflation has hit markets hard. Resource and commodity stocks have suffered leaving that sector battered and bruised. The slide has extended with few corrections to test the sellers.

The list of losers is long, coal, steel, crude, copper, and aluminum to name just a few of the industrial components that have been devalued.

The Oil drop from $100 a barrel just in the summer of 2014 has seen an epic energy shakeout. Commodities have real intrinsic value but the question is have they bottomed out after the precipitous drop?

The Canadian economy has backtracked after the boom with extreme exposure to resource volatility. As a result, the Canadian currency sits at multi year lows. The correlation to Crude makes the Loonie a backdoor proxy for the black gold.

The FXC Canadian Dollar exchange traded fund is down from 105 to under 75 in the last five years. An oversold market with volatility actually on the decline suggests a rebound rally is overdue.

The first upside target is in the low 80’s where the latest leg down began. The larger objective is a recovery to the 90 midpoint of the last five years.

The December option has over three months for development.

Buying actual shares is expensive and uses funds long-term in the stock play that could be put to better use. An In-The-Money Call option gives you the right to be long the ETF/shares from a lower strike price and costs much less than the stock itself.

The Options Way: Unlimited Upside Potential with Limited Risk.

An FXC long call option can provide the staying power in a potential larger trend extension. More importantly, the maximum risk is the premium paid.

One major advantage of using long options instead of buying or selling shares is putting up much less money to control 100 shares — that’s the power of leverage.

Choosing an option can sometimes be a daunting task with all of the choices and expiration months. Simply put, traders want to buy a high probability option that has enough time to be right.

The option strike price is the level at which you have the right to buy without any obligation to do so. In reality, you rarely convert the option into shares. Simply sell the option you bought to exit the trade for gain or loss.

There are two rules options traders need to follow to be successful.

Rule One: Choose an option with 70%-plus probability. The Delta is a measurement of how well the option reacts to movement in the underlying security. It is also important to buy options that payoff from only a modest price move.

There is no need to ONLY make money on the all but infrequent long shot price explosions.

Good Options can profit from only modest directional moves.

Any trade has a fifty/fifty chance of success. Buying options ITM options increase that probability. That Delta also approximates the odds that the option will be In The Money at expiration.

Buying better options is more expensive, but they are worth it — the chances of success are mathematically superior to buying cheap, long shot Out Of The Money lottery tickets that rarely ever pay off.

With FXC trading at $75.40, for example, an In The Money $73 strike option currently has $2.40 in real or intrinsic value. The remainder of any premium is the time value of the option.

Rule Two: Buy more time until expiration than you may need — at least three to six months for the trade to develop. Time is an investor’s greatest asset when you have completely limited the exposure risks.

Traders often buy too little time for the trade to develop. Nothing is more frustrating than being right but only after the option has expired premature to the market move.

Trade Setup: I recommend the December FXC $73 Call at $3.10 or less. A close in below $73 on a weekly basis or the loss of half of the option premium would trigger an exit.

An option play also has staying power with the ability to ride through Ups and Downs that would force most stock traders out of the position. Remember the August $74.40 lows are depths not seen in many years.

The option also behaves much like the underlying stock with a much less money tied up in the investment. The Delta is 78% for the $73 strike price.

December has over three months for development.

The maximum loss is limited to the $310 or less paid per option contract. The upside, on the other hand, is unlimited.

The FXC option trade break even is $76.10 at expiration ($73 strike plus $3.10 or less option premium). That is less than a dollar above FXC’s current price.

A recovery back into the $80 range would double the option value. The larger objective targets the midpoint of the last five years at $90 in FXC.

Essentially, you are long from $73 with over three months of time for ANY bearish development with absolutely limited risk to the $310 paid for the option.

Leave a Reply