New Trade Alert for (QQQ)

PowerShares QQQ Trust – Buy October QQQ $100 Call @$8.00 or less

Risk Rating: 3 (1 = lowest 5 = highest)

Below Break Even Probability: 45%

Max Loss Probability: 23%

Take Profit @ $12.00

Stop Loss @ 50% of premium paid

Home on the Range Low – Stocks Sideways Selloff

Hazy lazy days of summer have seen selling. In reality the S&P has dropped back to under unchanged for 2015 as the past six months have seen sideways in stocks.

An epic tight trading range of only 4 ½ percent from high to low since February in the broad market has been flat and frustrating.

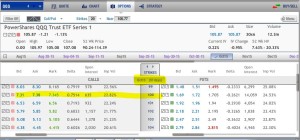

Tech on the other hand has continued to perform with the one year gain still hovering near double digits. The action in the QQQ index bounces between $112 and $106 with numerous swings for opportunists.

Buy low, sell higher…that’s the primitive plan…that works until it doesn’t.

The QQQ Exchange Traded Fund has been a strong performing diversified play for the last years as technology has outpaced the broad market. The Nasdaq score was plus 20% in 2014 to build on the big run the year before…

This current dip in the QQQ’s has eclipsed last week’s flush out low on the downside with much of these exaggerated moves due to dog days of summer trader apathy. Watch the channel bottom at $106 for a support pivot.

The upside target is $112 on a snap back to the channel top. The $102 area is the 52 week midpoint of the $114 to $90 trading track.

Only close below that $100.00 QQQ psychological support level on the weekly basis would negate the bullish trend.

Instead of buying long shares, a stock substitution strategy limits risk to the premium paid with unlimited upside profit potential. Less capital is required and the risk is less in dollar terms than buying shares outright.

The Options Way: Unlimited Upside Potential with Limited Risk.

A QQQ long call option can provide the staying power in a potential larger trend extension. More importantly, the maximum risk is the premium paid.

One major advantage of using long options instead of buying or selling shares is putting up much less money to control 100 shares — that’s the power of leverage.

Choosing an option can sometimes be a daunting task with all of the choices and expiration months and strikes. Simply put, traders want to buy a high probability option that has enough time to be right.

The option strike price is the level at which you have the right to buy without any obligation to do so. In reality, you rarely convert the option into shares. Simply sell the option you bought to exit the trade for gain or loss.

There are two rules options traders need to follow to be successful.

Rule One: Choose an option with 70%-plus probability. The Delta is a measurement of how well the option reacts to movement in the underlying security. It is important to buy options that payoff from only a modest price move.

There is no need to ONLY make money on the all but infrequent large price explosion.

Any trade has a fifty/fifty chance of success. Buying options ITM options increase that probability. That Delta also approximates the odds that the option will be In The Money at expiration.

Buying better options is more expensive, but they are worth it — the chances of success are mathematically superior to buying cheap, long shot Out Of The Money lottery tickets that rarely ever pay off.

With QQQ trading at $106, for example, an In The Money $100.00 strike option currently has $6.00 in real or intrinsic value. The remainder of any premium is the time premium of the option.

Rule Two: Buy more time until expiration than you may need. Time is an investor’s greatest asset when you have completely limited the exposure risks.

Traders often buy too little time for the trade to develop. Nothing is more frustrating than being right but only after the option has expired premature to the market move.

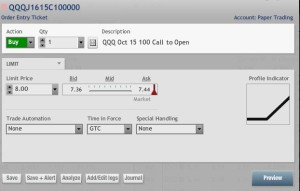

Trade Setup: I recommend the October QQQ $100.00 Call at $8.00 or less. A close below $102 on a weekly basis or the loss of half of the option premium would trigger an exit.

This option strike gives you the right to buy the shares at $100 per share with absolutely limited risk. The option Delta is 75% so this position will act much like long shares at a sharply investment cost.

This October option has two months for BULLISH market development.

The maximum loss is limited to the $800 or less paid per option contract. A stop loss is placed at half of the option premium paid to lessen dollar exposure.

The upside, on the other hand, is unlimited.

The QQQ option trade break-even is $108.00 at expiration ($100.00 strike plus $8.00 or less option premium).

If shares hit the retracement upper channel top target at $112, the option investment would gain more than 50%.

Leave a Reply